- #Turbotax 1040x amendment for free#

- #Turbotax 1040x amendment how to#

- #Turbotax 1040x amendment install#

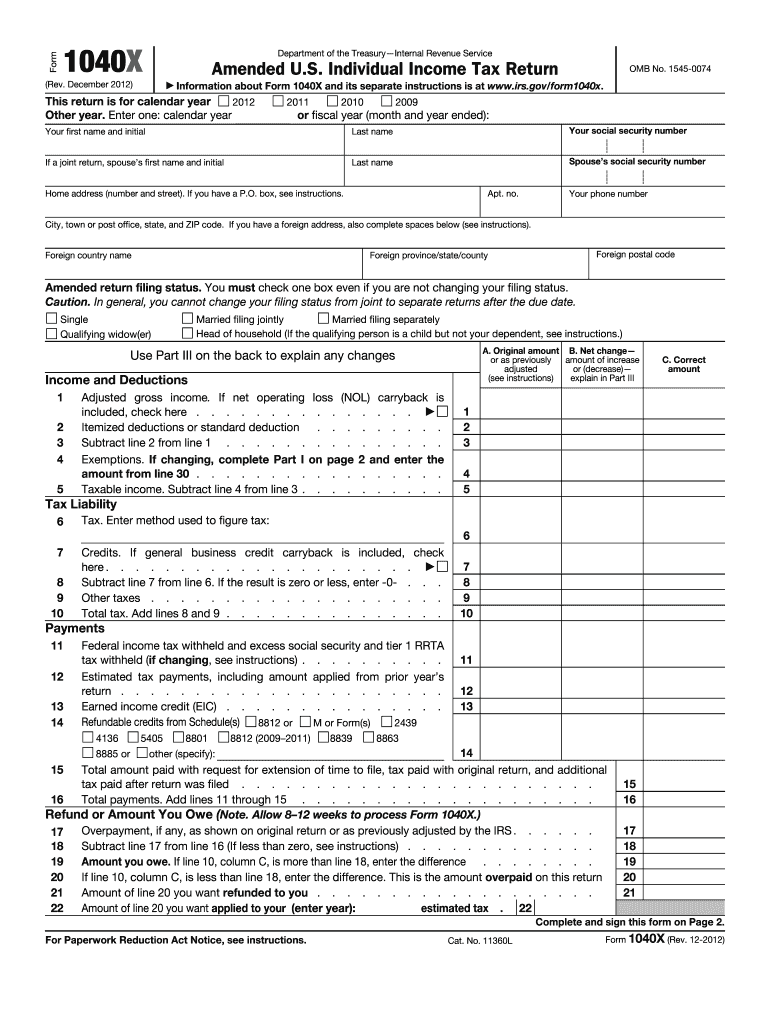

It seems that the last update to the program is not allowing more than one amendment to be e filed. I know that you are not allowed to e file more than 2 1040x returns for the same year. See the instructions for the form you originally filed (Form IT-201 or Form IT-203) to determine which form to file when amending your return (Form IT-201-X or IT-203-X). Level 1 yesterday I have e filed some 1040x amended returns with no problems. See the instructions for Form IT-201-X or IT-203-X for additional information about what to submit with your amended return. all your wage and tax statements, such as Form IT-2.ĭo not submit a copy of your original Form IT-201, IT-203, or IT-195.forms you submitted as attachments to your original return that are still applicable (for example, IT-196, IT-227, IT-558, IT-201-ATT, or IT-203-ATT), and.forms for any credits you are claiming or amending,.Submit all the forms relevant to the information in your amended return (even if you already submitted these forms with your original return), such as:

#Turbotax 1040x amendment how to#

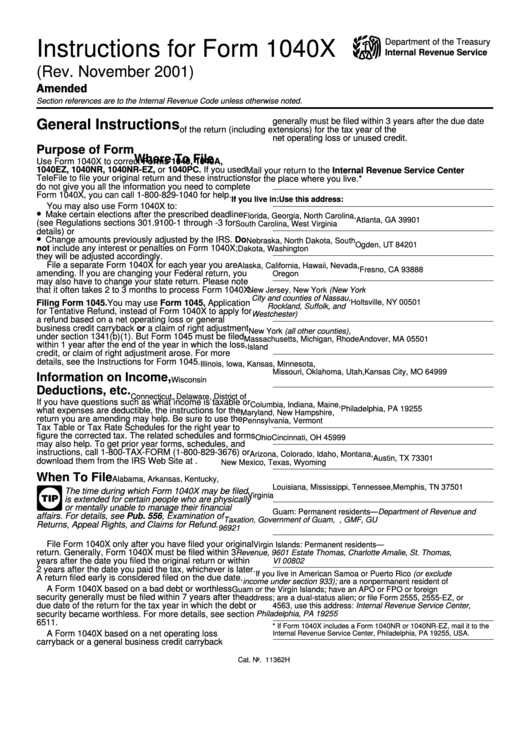

How to file an amended returnĬomplete your amended return as if you are filing the return for the first time. Follow the instructions you receive with the assessment. If you receive an assessment from the Tax Department, do not file an amended return strictly to protest the assessment. If you need to protest a paid assessment based on a statement of audit changes, do not use Form IT-201-X or Form IT-203-X.

#Turbotax 1040x amendment install#

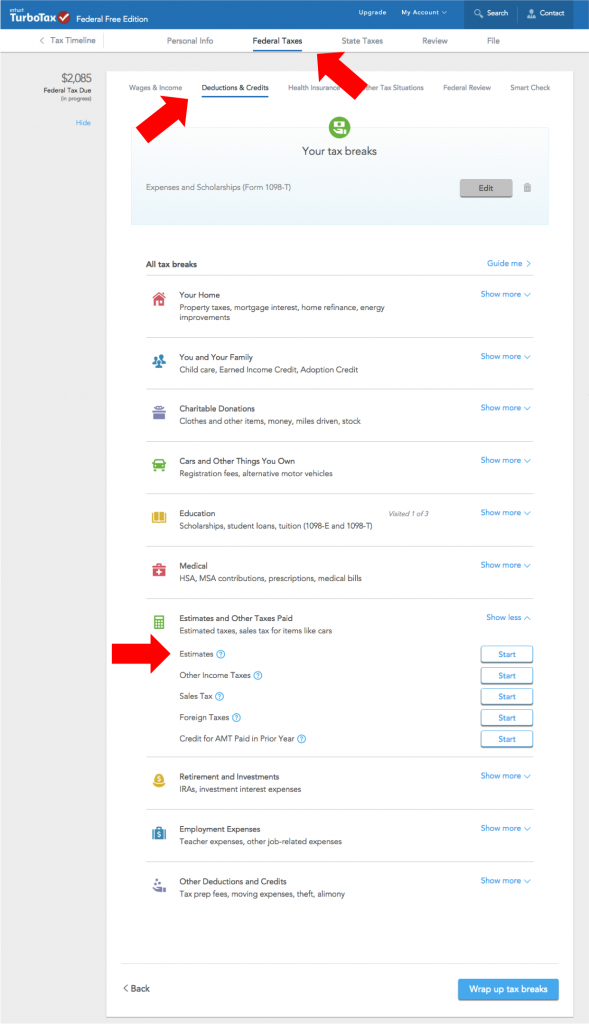

You need a full Windows or Mac computer to install it on. You have to buy a separate program for each year. You can only buy the download for prior years. Then you can amend it.įor prior years you have to buy the Desktop program. Then when it matches each line that you really filed you have to tell Turbo Tax you will mail it so it thinks it was filed. You have to recreate the actual wrong original return. To amend a return you did somewhere else, you would first have to fill out Turbo Tax like you are doing the original return.

#Turbotax 1040x amendment for free#

Ideally you should go back to who did it and they should amend it for free if it was their error. Weeks after you mailed your amendment, you can start tracking its progressĪmended Did you use Turbo Tax Online to do 2016? How to amend

Will take 12 weeks or longer to process an amended tax return.

Return, Form 1040X, can only be printed and mailed to the IRS, it cannot Your amendment results in a second refund, you'll get a check for the Owe money after amending, you'll just include payment with your mailed Need to wait for your amendment to finish processing, which can take Or the taxes due to be paid and processed by the IRS.įree to cash your refund check or spend it once you have it. Starting to amend the tax return, wait for the tax refund to be received Instructions can be found here when the form has been updated (expected within a couple weeks):

0 kommentar(er)

0 kommentar(er)